Health insurance may be necessary

But that does not mean that it is easy to understand. Insurance policies are notoriously confusing with pages of fine print and little-known riders that could prevent you from getting financial help when you need it. The key for you to save money on health insurance is to understand your policy in great detail. These health insurance tips will help you do just that while also answering the following questions.

- How can I get help in understanding my health insurance benefit booklet?

- How can I best access my health insurance policy?

- How do I know if my doctors accept my insurance?

- How can I find help in understanding prescription coverage?

- What is an Explanation of Benefits?

1. Read Your Benefit Booklet

Your first of five health insurance tips that will help you understand your policy is to check out policy basics in the benefit booklet. Where can I find help in understanding my health insurance benefit booklet? The insurance company will most likely send you this manual in the mail within a week or two of signing up for a new policy. In some cases, you may be able to access this information even sooner online.

This booklet is a great place to find out the specifics of what your policy covers. It can also help you compare the costs and savings of similar plans. Be sure to read this entire booklet so that you do not have to worry about health care bills the next time you see your doctor.

Your summary of benefits booklet will include several important elements, including the following:

- A glossary of health insurance terms to guide your reading

- A description of coverage included under your plan

- A description of any limitations to your coverage

- Detailed information about your financial obligations, including deductibles, copay and coinsurance

- Examples of coverage costs and cost sharing

- Information about renewing the policy

- Information for finding in-network providers

- Information for prescription drug coverage

- Contact information for learning more about the plan

Two of the most important parts to pay attention to in this booklet are the listings of your financial obligations and the coverage examples. Your financial obligations may include varying copay amounts based on the type of provider you see and coinsurance amounts based on whether or not you have yet met your deductible. The coverage examples will better help you understand this. For example, the insurance company may provide examples of pregnant patients receiving labor and delivery care and individuals requiring hospitalization for acute disease. Looking at these examples of hospital and physician charges, you will get a better idea of how much you will have to pay based on your deductible and coinsurance amounts.

2. Sign Up and Download Health Insurance Mobile App Technology

If you have questions and concerns about your health insurance policy, your insurance provider’s mobile app will most likely be able to give you answers. A free download of the applicable health insurance mobile app to your smartphone or tablet will give you the information you need at a tap of your finger. Depending on your insurance company, you may find a wide array of information here, including the following:

- Member cards to show to providers

- Links to find in-network providers close to home

- Information about your deductible and other basic parts of your explanation of benefits

- Links to download provider bills and explanations of benefits so that you can monitor claims

- Links to access telehealth if it is provided

- Contact information to let you ask any questions you may have

- Community groups for sharing questions and encouragement with other members

- Important health tips that help you reduce your risk for chronic conditions

- Information about which prescription medications are covered

Using the mobile app is sure to save you plenty of time. Instead of having to wait in a long telephone queue to get answers to simple questions, you may be able to find the answers yourself or access a faster chat function on your smartphone.

3. Make Sure Your Doctors Are in Your Network

How do I know if my doctors accept my insurance? The only way to answer this is to know what type of health insurance plan you have and then to assure yourself that your doctors are in-network. For example, if you have chosen a health maintenance organization (HMO) plan, you will have to choose your primary care doctor and get a referral from him before seeing specialists. However, a preferred provider organization (PPO) lets you choose from any provider you like.

You must also keep the differences between in-network and out-of-network providers in mind. If you want to get the full benefits of your health insurance plan, you will need to choose only in-network providers and medical facilities, which are fully covered under your plan. Out-of-network providers and facilities may only be partially covered or may not be covered at all. The main reason why many people do not like their current insurance policies is that their preferred providers or hospitals are not covered.

4. Learn More About Your Prescription Coverage

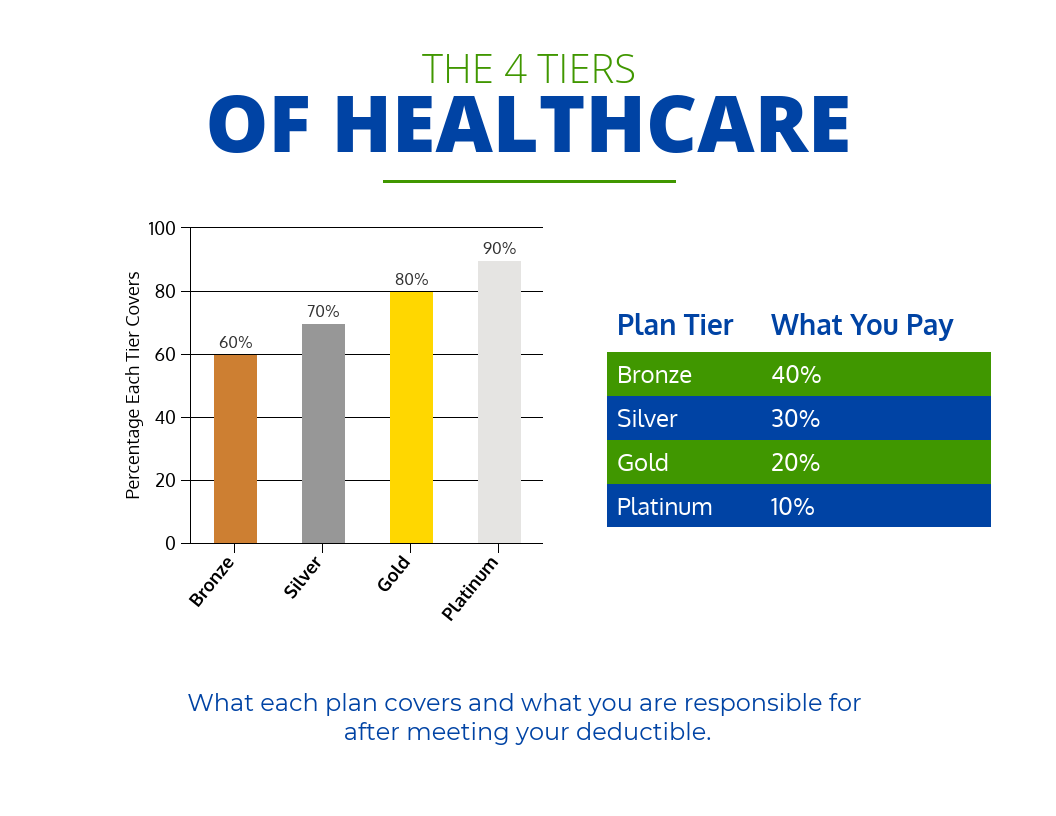

While understanding your coverage for doctor’s bills and facility fees is important, it is equally important to understand how your policy covers prescription medications. Today, nearly 66 percent of Americans take a prescription medication, and many take multiple medications daily. When it comes to understanding prescription coverage, you must have a copy of your plan’s formulary, which is the list of drugs covered under the plan, and you must know into which tier your medication falls.

For example, some health insurance plans have four tiers. The first tier includes the cheapest, generic drugs. The second tier has some generic drugs as well as the more affordable brand name drugs. Expensive, non-preferred drugs are found in the following tiers. You may want to ask your doctor if you can switch to a drug found in a lower tier.

5. Understand Your Explanation of Benefits

The final step to understanding your health insurance coverage is to check out your explanation of benefits or EOB. If you are asking yourself just what is an explanation of benefits or what is an EOB, you have come to the right place. The EOB will detail everything you need to know about a medical insurance claim that is sent to your insurance company from your provider or a medical facility. This paper is not a bill but instead tells you what your insurance will cover and what you will need to cover yourself.

The EOB will detail the services you received, how much they cost, how much insurance discounted them, how much your insurance company paid and how much you must cover. It is important to understand how to read your EOB so that you can avoid overpaying. If you have any questions after receiving the EOB, you should reach out to your health insurance company immediately.

Whether you have been wondering just what is an EOB or have simply thrown your hands up in despair over ever understanding your insurance policy, this clear guide gives you a place to start in understanding your benefits and your coverages. In fact, once you understand more about what is covered by your current policy and what benefits you actually need, you may even be able to change policies and save money on health insurance.

About mins ago