EPO Insurance Guide: How It Works, Who Needs It & Costs 2020

The main types of insurance plans you can buy are an exclusive provider organization (EPO) plan, a preferred provider organization (PPO) plan and a health maintenance organization (HMO) plan. Each person has unique medical needs, so the plan you need may vary. If you have ever wondered questions like, “Who is an EPO for?”, we can help you learn more about this kind of insurance plan.

What Is an EPO?

What is an EPO? More importantly, how does EPO insurance work? An EPO is basically a kind of health plan that uses a network of local hospitals and doctors. In general, an EPO is a little cheaper than a PPO plan. The biggest difference is that this health plan will not cover care outside of your network unless it is an absolute emergency. After getting EPO insurance explained, many people will choose this option if what they are looking for is a lower monthly premium in exchange for a higher deductible.

How Does EPO Insurance Work?

Is EPO right for you? The answer to this question really depends on the level of coverage you want. An EPO covers some of your medical expenses as long as you go to a health care provider that is within your particular network. If the hospital, clinic or doctor is not a part of the network, your services might not be covered.

While an EPO covers many of the costs associated with medical care, you will still have to pay copays. In addition, you will have to pay the deductible before your coverage kicks in. For example, if you have a deductible of $1,000, your plan will start paying for your care after you have paid $1,000 for your health services.

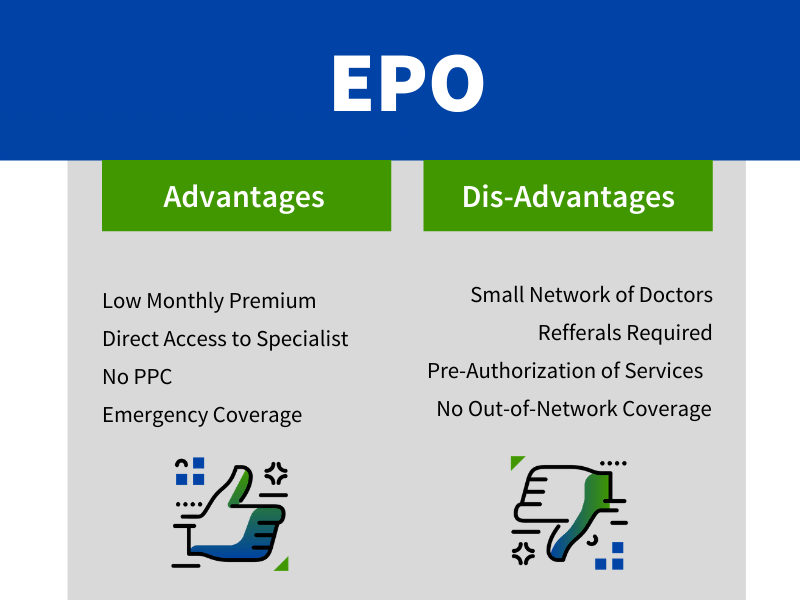

The Pros & Cons of an EPO

After you get EPO insurance explained to you, the benefits and drawbacks will determine whether this plan is the right choice for you or not. An EPO plan is a popular option because of its cost. Many people also enjoy the plan's provider network, although there are added costs for out-of-network providers.

When you look at the pros and cons of an EPO plan, the main thing that stands out is the cost of out-of-network providers. One of the biggest differences between any kind of health insurance plan is whether it covers out-of-network providers. Unless you are seeking emergency care, an EPO is probably not going to cover the cost of going to an out-of-network provider. If you are traveling to another city or state, you may have to pay the costs of medical care yourself. When you do need to go to an out-of-network provider for a non-emergency situation, you will generally need to get prior approval from your insurance provider if you want them to cover your medical bills.

According to the rules of EPO insurance, you can see a specialist without needing a referral from your primary care physician (PCP). With other plans, you generally have to select a PCP. Then, your doctor has to recommend for you to go to a specialist. An EPO generally does not require this added, unnecessary step.

The Advantages of EPO Insurance

If you are interested in getting EPO insurance, you may enjoy the following benefits:

- EPO insurance is generally cheaper than alternative plans.

- When you use an in-network provider, the cost is generally quite low.

- You can see a specialist without going to your physician first.

- You are not required to have a primary care physician.

The Disadvantages of EPO Insurance

To figure out, “If an EPO Insurance plan is right for me?”, we also have to look at the drawbacks to this kind of plan. While an EPO is often cheaper than alternative options, this is only true in certain kinds of situations. For example, this plan can get expensive if you frequently have to use out-of-network providers. EPO plans have some of the following drawbacks.

- Out-of-network providers are not covered by this plan.

- EPO plans are generally not the cheapest option, but they are also not the most expensive plan.

- You have to use in-network providers.

How Much Does an EPO Cost?

The cost and rules of EPO insurance depend entirely on your plan. In general, you will be expected to pay a monthly premium as you do with other health insurance plans. Your premium costs will depend on your geographic location and the plan you choose. In most cases, EPO plans have a middle-of-the-road cost when it comes to premiums. Meaning they are usually a little more affordable monthly than a PPO, and slightly more expensive monthly than an HMO in most cases.

When you look at your EPO plan cost, it is also important to consider what your plan covers. If your plan barely covers anything, then a low-cost premium might be a bad idea. Often, low premiums will come with a higher deductible or other trade-offs. In comparison, more expensive plans will often let you use out-of-network providers.

Who Needs EPO Insurance?

Everyone needs some form of health insurance. Even if you are in the best of health, accidents can happen. An EPO plan is a useful insurance plan, but it is not the right choice for everyone. This health plan may be right for you if you meet the following criteria.

- You want a lower negotiated rate than you can find with a PPO or HMO plan.

- You want a middle-of-the-road option.

- You do not want to go to your physician for a referral each time you want to see a specialist.

- You are not concerned with out of network coverage.

- You do not travel a lot.

Is an EPO Right for You?

After learning the answer to, “Who is an EPO for?”, you can decide if an EPO is right for your circumstances. The rules of EPO insurance focus on in-network hospitals, doctors and other providers. As long as you use in-network providers, you can enjoy lower negotiated costs. If this is what you want from your health insurance, then an EPO plan may be the right choice for your needs.

About mins ago