Compare: HMO vs PPO

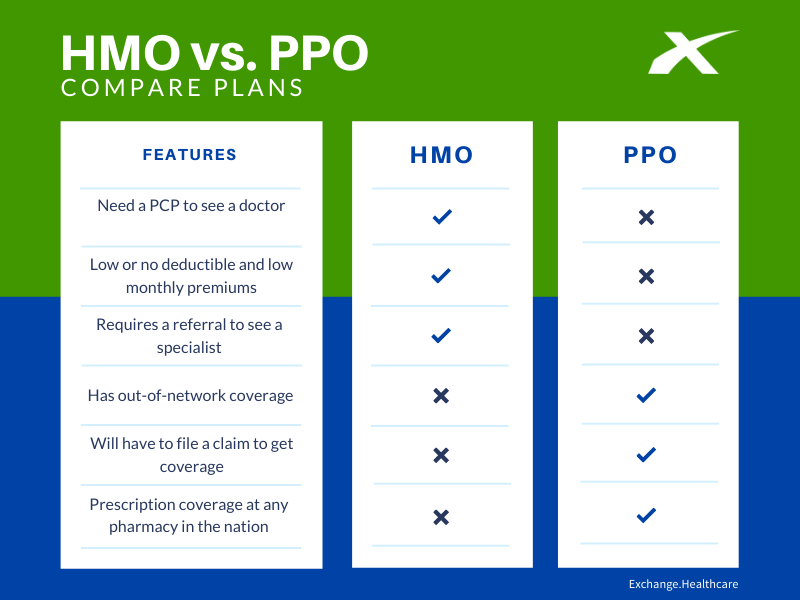

So, no matter who your insurance carrier is most plans come in 2 main network types an HMO or a PPO. Just like anything else, there are ups and downs to each plan type. In most states you will have access to both, but some states only have HMOs on the marketplace. Now we will go over all of the differences, what they mean to you, and why they matter. The main differences between an HMO and a PPO:

- Access to Doctors

- Size of Network

- Out-of-Network coverage

- Cost

- Referrals

- Need of a PCP

- Claim handling Re-edit Info Graph on Comparison chart

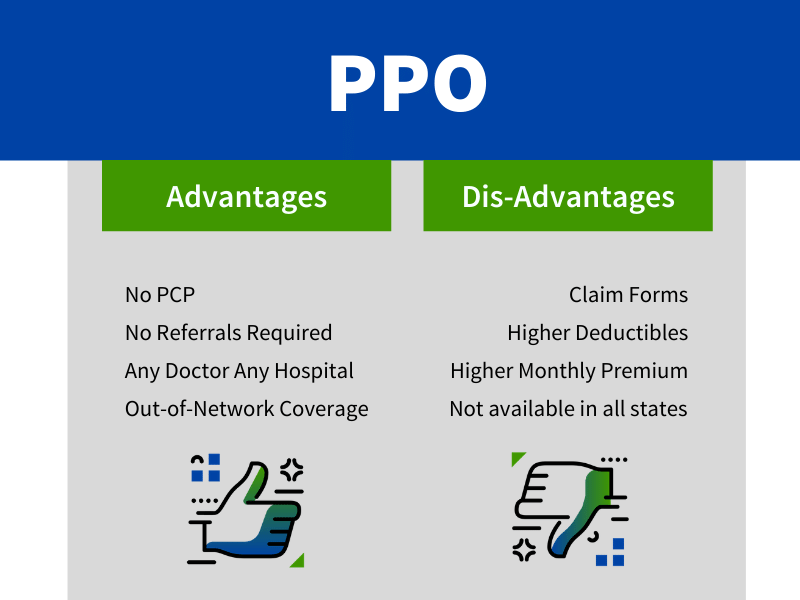

What is a PPO?

A Preferred Provider Organization or PPO is a subscription-based health care arrangement. Similar to an HMO a PPO has a network of doctors and facilities. But they also offer out-of-network coverage. You will also not need a referral to see a specialist. So, there is no “Gate Keeper” which saves you money for the extra doctor visit.

While PPOs do provide the most flexibility out of the two, they also come with a higher price tag in most cases. With No PCPs if you are someone who sees a specialist often, PPOs may be your best option when available.

What is an HMO?

A Health Maintenance Organization or an HMOs primary goal, as the name says, is to keep you healthy. It is much cheaper to keep you healthy, than it is to pay for expensive treatment if you were diagnosed with a major condition. Therefore, they usually provide preventative care at little or no cost. HMOs have a network of doctors and facilities and to receive care, you will need to go to someone within that network. These doctors and facilities have agreed to provide service at a pre-negotiated price. Most HMOs have some limits annually as to how many times you can see the doctor or get certain tests. So ensure you look at the coverage carefully before deciding.

What cost more an HMO or a PPO?

In most cases PPOs tend to be a little pricier monthly than HMOs. HMOs will usually have smaller copays as well as deductibles. In general, most costs are lower with an HMO. You must use a PCP with an HMO, so if you do see specialists regularly, you may want to enroll in a PPO plan. PPO/HMO Price Chart Here In short when it comes to overall cost, while PPOs may cost slightly more, lower premiums usually mean higher out-of-pocket expenses. Also, PPOs include some services you would have to pay extra for through an HMO and have more extensive coverage.

Access to Doctors: HMO vs PPO

Now when it comes to accessing doctors the difference between an HMO and a PPO become more apparent. Like we mentioned before, with an HMO you will be assigned a PCP or Primary Care Physician and your PCP is basically your main doctor. Their job is to manage your healthcare as a whole. You will go to this doctor for everything from a cold, or birth control, all the way to heart issues. Then, is they see fit, they will refer you to a specialist. If they see fit. Now on the other hand, with a PPO, you usually do not have a PCP and can go directly to a specialist as you see fit. This is a very big deal to many consumers. As well with an HMO, in most cases you will have No out-of-network coverage. So, if you end up at a facility out of network, you will receive no coverage and be responsible for the entire bill. Remember just because your surgeon is in network, does not mean the anesthesiologist or the surgical assistant are. This has cause issues for many patients in the past. If you have a PPO on the other hand, you will have access to any doctor or hospital and still receive coverage. Now, in many cases you will have slightly less coverage or have to meet a separate deductible, but you will be covered.

They key word here is flexibility. If you need true control over your access to doctors, I would go with a PPO. What’s better an HMO or a PPO? Here are the main factors you want to keep in mind when choosing between an HMO and a PPO:

- How often do you see specialists?

- Do you need to keep your doctors?

- How often do you travel?

- Monthly Cost

- Out-of-pocket cost

Again, if you do not travel much or see a specialist often HMOs will usually do the job effectively, while keeping your monthly payment low. But if flexibility, seeing a specialist or traveling is a major issue to you, you may want a PPO.

Keep in mind there are many options outside of the marketplace such as short-term or group plans recently made available through Trumpcare laws. We always recommend speaking to a licensed agent to go over options and make sure you are getting the best plan for the best price.

About mins ago