PPO Insurance Guide: How it Works, Who Needs it & Costs 2020

A PPO or Preferred Provider Organization is one kind of managed health care plan. PPOs, also known at times as a Participating Provider Organization or a Preferred Provider Option, first emerged in the 1970s and early 1980s as a competitor to HMOs. They are a subscription-based type of health insurance in which maximum benefits are provided to subscribers who use a list of in-network preferred providers.

In-network providers associated with a PPO include hospitals, doctors and other health professionals who agree to lower rates for members of the PPO. While there is a limited number of preferred providers associated with many PPOs, it is often possible for members to visit any of them without a referral from their primary care physician or pre-approval by the insurance company, although every PPO varies.

How does PPO insurance work?

If you are wondering, "How does PPO insurance work?" there are several things to keep in mind when considering this type of coverage. Like other types of health insurance, PPO members pay a monthly premium for their coverage. In most cases, there is also an annual deductible that members must reach before the insurance payments kick in. There is often also a co-pay associated with each medical visit, which could be a set dollar amount or a percentage-based co-pay. In most cases, PPOs have a slightly higher co-pay and deductible than most HMOs.

There is a strong benefit for PPO members to visiting in-network physicians and hospitals. PPOs are full-service health care plans, so there is coverage for out-of-network health providers. However, it is typically offered at a significantly reduced percentage, and thus a much higher co-pay, than that for in-network visits and treatment.

Those health care providers who are part of the PPO receive negotiated fees for services, as established through their agreements with the insurance company. The PPO will also use a set fee schedule for out-of-network claims that documents what the insurance company finds to be "reasonable and customary." If the amount of a claim is higher than this fee schedule, the member will be responsible for the difference. Some PPOs may deny some out-of-network claims, depending on the reason for the claim and the fee associated with the service.

Many HMOs only provide coverage for in-network providers, so PPOs can be more flexible in this regard. They also tend to offer more flexibility in terms of referrals and medical choices, and focus less on primary care providers as a central hub of care for each patient.

Who needs a PPO health insurance plan?

So, who is PPO for, and who needs PPO insurance? A PPO can be a great choice for many individuals and families, especially those who prize flexibility and choice in health care decision-making. PPO members typically do not need to select a primary care physician. They can go to any doctor they wish without first receiving a referral from a PCP. In-network providers will be covered at higher, in-network rates while out-of-network providers will be covered at lower rates. Either way, however, members' health appointments should receive some level of coverage.

If you wonder who needs PPO insurance, people who travel frequently or who need to visit specialists on a regular basis may prefer this type of program. The lack of a referral requirement can eliminate delays and bureaucracy, especially when members need to make appointments with multiple specialists or are seeking a second opinion. This can also be important for people who travel frequently and are unable to go to their primary care physician's office whenever they need medical care.

Who is PPO for? PPOs are also a good choice for people who are committed to doing research before committing to a doctor or a hospital. By confirming, when possible, in advance that a doctor is in-network, members can receive significant savings on their health expenses. In an emergency situation, members can rest assured that they will receive some coverage for reasonable and customary fees for their medical care.

In short, a PPO can be an excellent choice for many people, but especially those who:

- Prize flexibility and individual control over health care decisions.

- Do not want to go to a primary care provider for referrals before seeing a specialist.

- Are willing to take time to look for in-network care but want the option for some out-of-network coverage.

- Travel frequently and need more options for care in different places without going through a PCP

Rules of PPO insurance plans

To have the most successful experience with this type of coverage, it is important to understand the rules of PPO insurance.

In most cases, non-emergency hospital admissions and some outpatient surgeries must be approved in advance by the PPO. Called a pre-certification requirement, this policy is used by insurance companies who review the procedure to verify that it is medically recommended and appropriate for the type of condition being treated. In general, pre-certification requirements do not apply to emergency admissions, but members should review their insurance information to understand all relevant policies and contact their PPO as soon as possible after an emergency hospital admission.

PPO members' medical records also typically receive utilization review from the insurance company. This form of review is intended to ensure that the treatments being provided are medically recommended and necessary rather than being performed on a large number of patients solely to generate fees for the doctor, hospital or other provider.

PPOs do not require referrals or a primary care physician to handle medical decisions, but patients who want to receive maximum coverage for their services should verify the in-network status of any physician before making an appointment. PPOs are similar to other types of insurance arrangements like HMOs and EPOs (Exclusive Provider Organizations). However, they provide some level of out-of-network coverage while those types of insurance programs may deny it altogether.

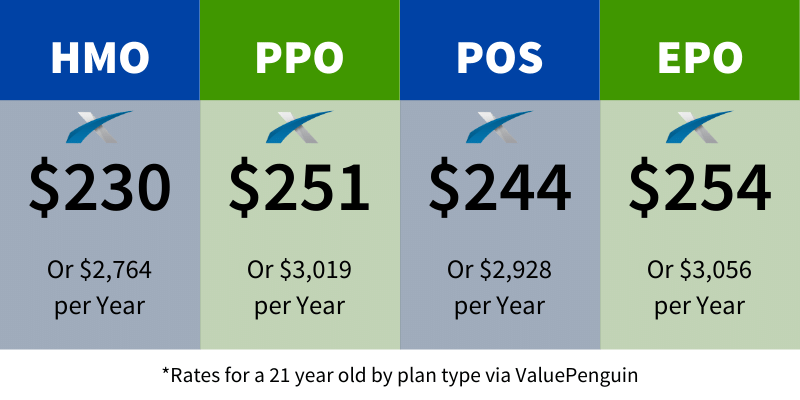

How much does a PPO cost?

In general, PPOs are somewhat more costly than HMOs, when measured on the basis of monthly premiums or annual deductibles. In most cases, the monthly cost of a PPO is around 10% higher than that of a comparable HMO.

However, for people who want the peace of mind and security of ensuring that they will receive some coverage for out-of-network care, PPOs may be a less expensive option in the long run. Members may have multiple options with different deductibles and co-pays. In most cases, higher co-pays come with lower monthly premiums, as do higher deductibles. Other plans may offer lower co-pays and deductibles with a higher monthly cost.

PPOs may be more expensive than HMOs because of two of their main benefits: greater flexibility and the lack of reliance on the primary care provider. In an HMO, the PCP is essentially a gatekeeper of medical care, keeping costs down by assessing necessity of care every time they issue a referral. This can also cut down on co-pays, because members only need to pay for one co-pay for an appointment rather than two, first for the PCP and then for the specialist.

PPOs eliminate that gatekeeper, which means that monthly costs may be higher. They also offer greater choice and control over health care decisions. In addition, many PPOs offer more comprehensive coverage choices which may not be approved or available through less expensive HMOs or other low-cost insurance plans.

Benefits/Advantages/Pros/Cons of PPO

When choosing a health insurance policy, it is important to understand the benefits/advantages/pros/cons of PPO. Selecting the right type of coverage can be a highly individual decision, so reviewing these aspects can help people decide whether a PPO is the right choice for them and their families.

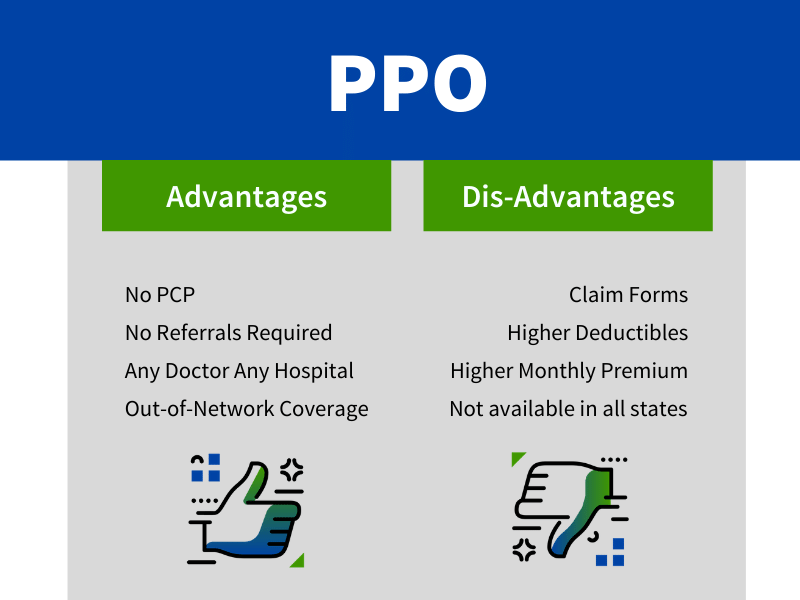

Some of the advantages of a PPO include the following:

- No need to select or rely on a primary care provider (PCP).

- No requirement for a referral before seeing a specialist.

- Receiving some level of coverage for medical care with any doctor, hospital or health care 1)rovider.

- Receiving some access to out-of-network coverage.

- Strong discounts and reduced co-pays for visiting in-network providers

On the other hand, some of the most commonly cited disadvantages of PPOs include the following:

- Claim forms and other paperwork are still required for coverage, including advance approval or hospital admissions and surgeries.

- Deductibles may be higher overall than other types of managed care insurance.

- Monthly premiums may be somewhat higher than those of an HMO.

- Availability of PPOs may be limited in some states and areas.

Flexibility and choice are particularly important to many patients, especially those who need to see specialists frequently or who are often unable to first visit a primary care provider due to travel or other scheduling concerns. In short, PPOs offer more individual control over each person's medical choices. This is especially important in areas where there may be a limited number of in-network providers or patients are concerned about quality of care.

In-network coverage is a major concern for many health care consumers. Sometimes, different doctors at one hospital may be in-network or out-of-network, especially if a specialist from outside the facility is brought in. Some patients have reported, for example, that their surgeon is an in-network provider, but the anesthesiologist was not, leaving them with a large bill when they are insured through an HMO or an EPO.

With a PPO, members will receive at least some coverage for out-of-network providers according to a reasonable fee schedule, which can make a substantial cost difference, especially for large procedures or complex care.

However, in some cases, people may need to be billed individually for their services and then file a claim with the PPO for coverage when they go to an out-of-network provider. Many patients may find it difficult to handle the initial bill, even if their claim is later covered, while others may be anxious about the potential for a claim denial or the amount that will be covered. In-network care is generally covered from the first point of interaction, aside from mandatory co-pays and deductibles.

Is PPO right for you?

The question remains: Is PPO right for you? The right type of insurance can be a very individual choice, depending on the factors that are most important for each person or family receiving care. For many people, flexibility and choice are primary concerns, while others place more emphasis on monthly premiums, co-pays, deductibles and other out-of-pocket expenses.

People who travel frequently and cannot regularly see a primary care provider may find that a PPO is a great choice for them, as may those who need to see multiple specialists regularly, especially if they are uncomfortable going to a PCP for a referral every time.

You can benefit from learning more about the different types of health insurance available to you and the costs and benefits provided. Having a full view of your options can help you determine if the features and benefits of a PPO make it the right choice for you and your family's health coverage.

Exchange Healthcare News

As the Affordable Care Act creates millions of new health insurance customers and provides new options for the already-insured, confusion about basic insurance concepts could make it difficult for people to make the right choices.

About 50 mins ago